How Companies Work

See companies as complex systems with emergent behaviors.

Some History and Context

“Because its purpose is to create a customer, the business enterprise has two — and only these two — basic functions: marketing and innovation.”

Alfred Chandler: Maximizing Function

“In many sectors of the economy the visible hand of management replaced what Adam Smith referred to as the invisible hand of market forces. The market remained the generator of demand for goods and services, but modern business enterprise took over the functions of coordinating flows of goods through existing processes of production and distribution, and of allocating funds and personnel for future production and distribution. As modern business enterprise acquired functions hitherto carried out by the market, it became the most powerful institution in the American economy and its managers the most influential group of economic decision makers.”

— Excerpted from Alfred Chandler’s “The Visible Hand” (1977)

Herbert Simon: Good-Enough Actions

“[I]f there were no limits to human rationality administrative theory would be barren. It would consist of the single precept: Always select that alternative, among those available, which will lead to the most complete achievement of your goals. The need for an administrative theory resides in the fact that there are practical limits to human rationality, and that these limits are not static, but depend upon the organizational environment in which the individual's decision takes place. The task of administration is so to design this environment that the individual will approach as close as practicable to rationality (judged in terms of the organization's goals) in his decisions.”

— Excerpted from Herbert Simon’s “Administrative Behavior” (1947)

Bruce Henderson: Product Portfolio

“To be successful, a company should have a portfolio of products with different growth rates and different market shares. The portfolio composition is a function of the balance between cash flows. High growth products require cash inputs to grow. Low growth products should generate excess cash. Both kinds are needed simultaneously. […]

The need for a portfolio of businesses becomes obvious. Every company needs products in which to invest cash. Every company needs products that generate cash. And every product should eventually be a cash generator; otherwise it is worthless.”

— Excerpted from Bruce Henderson’s “The Product Portfolio” (1970)

The Ofmos Lens

Take an outside-in perspective on companies by analyzing their activity relative to human nature. Expand your visibility well beyond the product’s life span or industry, deepening your insights past those provided by the functional view of the firm as a value chain or business model.

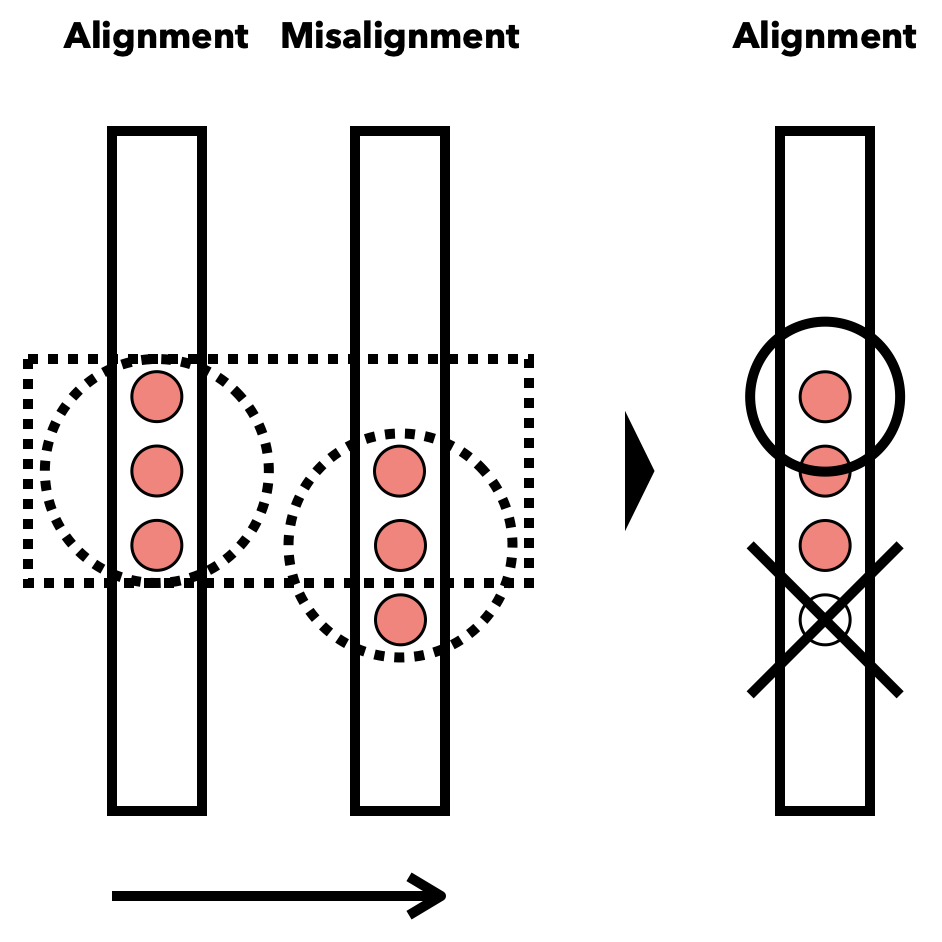

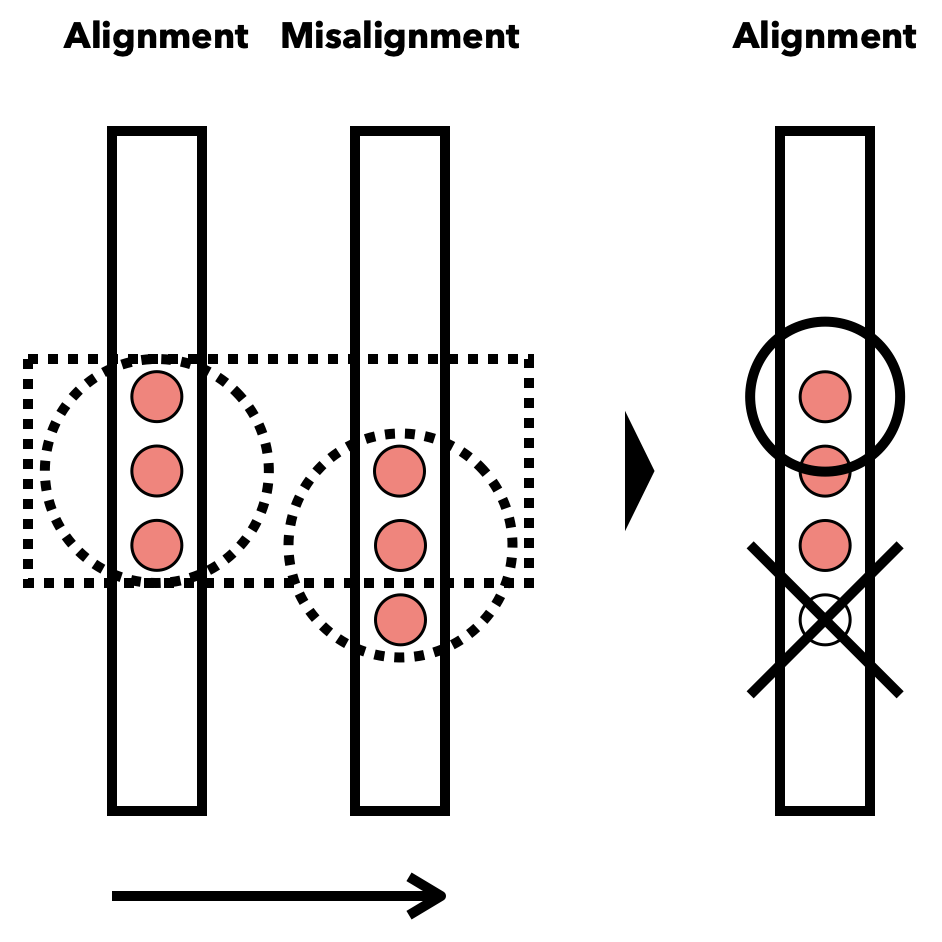

Look at the bigger picture through the Ofmos lens and understand the two corporate behaviors that fundamentally underlie a company’s health. One is the company’s strategic intent (Focus), and the other is its emerging approach to business (Center). Keep the two aligned to succeed.

Theory of the Firm

Center of Ofmos Portfolio

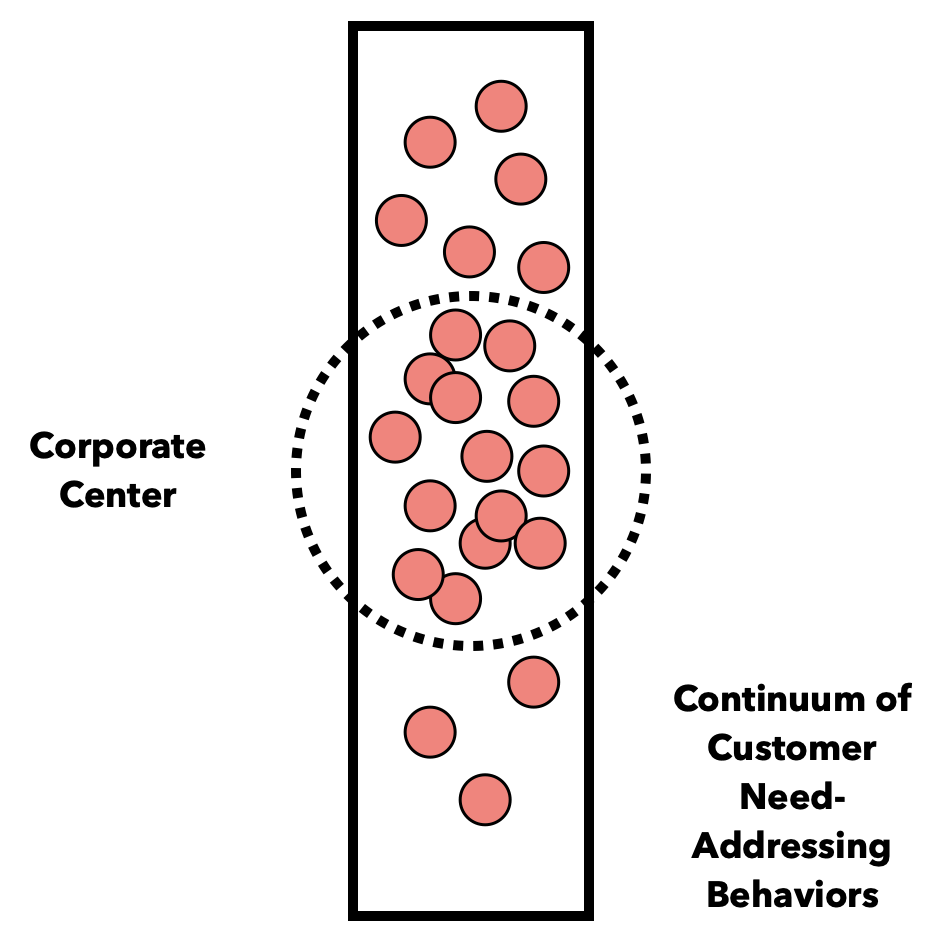

Note that, as a company strives to increase its efficiency, the collection of ofmos that defines it tends to cluster and give rise to the Corporate Center.

Focus of Ofmos Portfolio

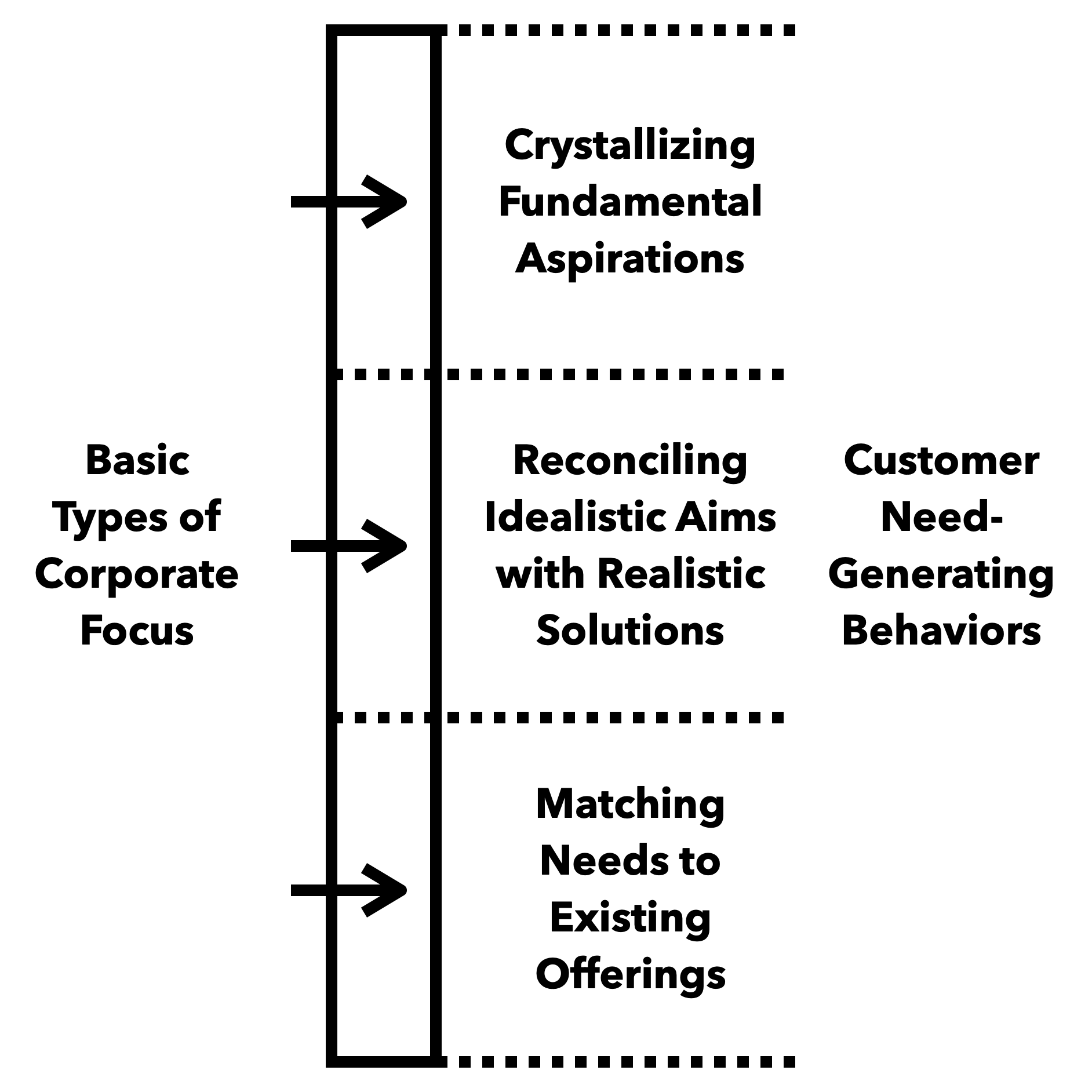

View a company’s intent, which embodies the leadership team’s top-down approach to business, as a focus on certain customer needs and behaviors.

Focus-Center Alignment

Understand a company’s health over time from the perspective of the alignment between its rather-fixed Focus and its emergent and commoditizing Center.

Model in Action

The Ofmos View of the Firm

Look at companies as dynamic collections of ofmos. (This 2007 visualization reflects an earlier stage of theory development, with a right-to-left commoditization motion.)

Deep Dive

Needs and Value

The article “A Natural Theory of Needs and Value” describes the new view on human nature.

Business Success

The picture book “Spointra and the Secret of Business Success” details the new worldview in a fun way.

Beyond the Fun

The 49-page (draft) letter to the readers places the new theories inside the broader literature.